apps30.ru

Tools

Flotek Industries Stock

NYSE - Nasdaq Real Time Price • USD. Flotek Industries, Inc. (FTK). Follow. Compare. + (+%). At close: August 30 at PM EDT. View Flotek Industries, Inc FTK investment & stock information. Get the latest Flotek Industries, Inc FTK detailed stock quotes, stock data, Real-Time ECN. Flotek Industries Inc. · · Partner Center · Your Watchlists · Recently Viewed Tickers · FTK Overview · Key Data · Performance · Analyst Ratings. Sell. Track Flotek Industries Inc (FTK) Stock Price, Quote, latest community messages, chart, news and other stock related information. Share your ideas and get. Flotek Industries Inc Performance ; Diluted EPS (TTM), ; Revenue Growth YOY, ; Earnings Growth YOY, 0 ; Profit margin, Flotek Industries Inc ; Previous Close: ; Volume: ; 3 Month Average Trading Volume: ; Shares Out (Mil): ; Market Cap: Key Stats · Market CapM · Shares OutM · 10 Day Average VolumeM · Dividend- · Dividend Yield- · Beta · YTD % Change Given the current short-term trend, the stock is expected to fall % during the next 3 months and, with a 90% probability hold a price between $ and. Over the past 5 years, Flotek Industries, Inc.'s stock price has decreased by %. Flotek Industries, Inc.'s stock price is currently approximately $ NYSE - Nasdaq Real Time Price • USD. Flotek Industries, Inc. (FTK). Follow. Compare. + (+%). At close: August 30 at PM EDT. View Flotek Industries, Inc FTK investment & stock information. Get the latest Flotek Industries, Inc FTK detailed stock quotes, stock data, Real-Time ECN. Flotek Industries Inc. · · Partner Center · Your Watchlists · Recently Viewed Tickers · FTK Overview · Key Data · Performance · Analyst Ratings. Sell. Track Flotek Industries Inc (FTK) Stock Price, Quote, latest community messages, chart, news and other stock related information. Share your ideas and get. Flotek Industries Inc Performance ; Diluted EPS (TTM), ; Revenue Growth YOY, ; Earnings Growth YOY, 0 ; Profit margin, Flotek Industries Inc ; Previous Close: ; Volume: ; 3 Month Average Trading Volume: ; Shares Out (Mil): ; Market Cap: Key Stats · Market CapM · Shares OutM · 10 Day Average VolumeM · Dividend- · Dividend Yield- · Beta · YTD % Change Given the current short-term trend, the stock is expected to fall % during the next 3 months and, with a 90% probability hold a price between $ and. Over the past 5 years, Flotek Industries, Inc.'s stock price has decreased by %. Flotek Industries, Inc.'s stock price is currently approximately $

Price Data & News ; NameFlotek Industries, Inc. ; Last Price$ ; Change$ ; Change %%.

The stock price for Flotek Industries (NYSE: FTK) is $ last updated August 7, at AM EDT. Q. Does Flotek Industries (FTK) pay a dividend? A. There. Flotek Industries Inc Frequently Asked Questions ; What is Flotek Industries Inc(FTK)'s stock price today? The current price of FTK is $ The 52 week high of. Stock price for similar companies or competitors ; Flotek Industries Logo. Newpark Resources. NR. $, % ; Flotek Industries Logo. Oil States International. In the last 3 years, FTK stock traded as high as $ and as low as $ What are the top ETFs holding Flotek. 50 minutes ago. About Flotek Industries (FTK) ; Avg. daily volume. K ; EBITDA (TTM). $M ; Open. $ ; Price / earnings ratio. x ; Yesterday's range. $ - $ The last closing price for Flotek Industries was $ Over the last year, Flotek Industries shares have traded in a share price range of $ to $ What Is the Flotek Industries Inc Stock Price Today? The Flotek Industries Inc stock price today is What Is the Stock Symbol for Flotek Industries Inc? Flotek Industries | FTKStock Price | Live Quote | Historical Chart ; Pason Systems, , , % ; RPC, , , %. Flotek Industries, Inc. engages in the business of creating unique solutions to reduce the environmental impact of energy on air, water, land, and people. The current price of FTK is USD — it has increased by % in the past 24 hours. Watch Flotek Industries, Inc. stock price performance more closely on the. The average Flotek Industries stock price for the last 52 weeks is For more information on how our historical price data is adjusted see the Stock Price. View the latest Flotek Industries Inc. (FTK) stock price, news, historical charts, analyst ratings and financial information from WSJ. Discover real-time Flotek Industries, Inc. Common Stock (FTK) stock prices, quotes, historical data, news, and Insights for informed trading and investment. Flotek Industries Inc. ; Volume, K ; Market Value, $M ; Shares Outstanding, M ; EPS (TTM), $ ; P/E Ratio (TTM), Historical stock prices. Current Share Price, US$ 52 Week High, US$ 52 Week Low, US$ Beta, 11 Month Change, %. Flotek Industries Inc Registered ShsStock, FTK ; Balance Sheet in Mio. USD · Total liabilities, ; Key Data in USD · Sales per share, Flotek Industries, Inc. is a technology-driven, specialty green chemistry and data company. The Company’s segments include Chemistry Technologies and Data. Flotek Industries Inc ; Apr, Initiated, Alliance Global Partners, Buy, $7 ; Jul, Initiated, Noble Capital Markets, Outperform, $ Flotek Industries ; Market Cap. $M ; P/E Ratio (ttm). ; Forward P/E · ; Diluted EPS (ttm). ; Dividends Per Share. N/A.

How Much Retirement Income Will I Have

This amount is based on the household income earned during the year immediately before your retirement. Retirement Age entered, even if the participant is currently much younger. will have saved by the time the participant reaches the Retirement Age. The. Experts recommend saving 10% to 15% of your pretax income for retirement. When you enter a number in the monthly contribution field, the calculator will. Use our retirement savings calculator to help find out how much money you need to save for retirement ll show you what you need to save to make reality meet. How do you calculate the progress towards my goal? Your retirement income may be made up of several components that we have estimated on your behalf. Your. Will I have enough money saved up when it comes time to retire? How much monthly income can I expect? How does adjusting my contribution rate today change. If you do not give a retirement date and if you have not reached your normal (or full) retirement age, the Quick Calculator will give benefit estimates for. The rule of thumb is to have enough to draw down 80% to 90% of your pre-retirement income. Or, using a simple formula like saving 12 times your pre-retirement. How much income will you need in retirement? Are you on track? Compare what you may have to what you will need. This amount is based on the household income earned during the year immediately before your retirement. Retirement Age entered, even if the participant is currently much younger. will have saved by the time the participant reaches the Retirement Age. The. Experts recommend saving 10% to 15% of your pretax income for retirement. When you enter a number in the monthly contribution field, the calculator will. Use our retirement savings calculator to help find out how much money you need to save for retirement ll show you what you need to save to make reality meet. How do you calculate the progress towards my goal? Your retirement income may be made up of several components that we have estimated on your behalf. Your. Will I have enough money saved up when it comes time to retire? How much monthly income can I expect? How does adjusting my contribution rate today change. If you do not give a retirement date and if you have not reached your normal (or full) retirement age, the Quick Calculator will give benefit estimates for. The rule of thumb is to have enough to draw down 80% to 90% of your pre-retirement income. Or, using a simple formula like saving 12 times your pre-retirement. How much income will you need in retirement? Are you on track? Compare what you may have to what you will need.

A powerful retirement calculator that helps you determine how much to save, how to invest, and how much income you'll have. Get started. Retirement Income Tools. The amount you are currently putting into your retirement fund can (and should) be anywhere from % of your gross income. · Your contribution to Social. Many experts maintain that retirement income should be about 80% of a couple's final pre-retirement annual earnings. Fidelity Investments recommends that you. Get rate alerts Use this calculator to compute how much you will be able to regularly withdraw from your savings account before you run out. Free calculators that help with retirement planning with inflation, social security, life expectancy, and many more factors being taken into account. Put your retirement savings, your contributions and your annual return into the retirement calculator, and we'll show you how much you can expect to have. So, we did the math and found that most people will need to generate about 45% of their retirement income (before taxes) from savings. Based on our estimates. To help you stay on track, we suggest these age-based milestones: Aim to save at least 1x your income by age 30, 3x by 40, 6x by 50, and 8x by Your personal. It may surprise you how significant your retirement accumulation may become simply by saving a small percentage of your salary each month in your (k) plan. This calculator can help you estimate how much money you might expect to receive in retirement from your (k). Get started. The first step is to get an estimate of how much you will need to retire securely. One rule of thumb is that you'll need 70% of your annual pre-retirement. Typically 10 to 12 times your annual income at retirement age. While there is no one-size-fits-all plan, there are some common guidelines and benchmarks. Get an estimate. Check your Social Security account to see how much you'll get when you apply at different times between age 62 and With a lifetime income product from TIAA you can get regular retirement payments that will last as long as you live. Learn how it works in our new digital. How much do you need in retirement and how much are you going to have? Those A forecast of the likely pension income you'll get when you retire. Retirement planning is an essential step in your overall financial picture. This preretirement calculator will help you determine how well you have prepared. Be aware that the calculator does not take taxes on your retirement income into account so your spendable income will be less. The actual results will also. Be aware that the calculator does not take taxes on your retirement income into account so your spendable income will be less. The actual results will also. This rule of thumb suggests that you'll have to ensure you have 80% of your pre-retirement income per year in retirement. This percentage is based on the fact. Someone between the ages of 26 and 30 should have times their current salary saved for retirement. Someone between the ages of 31 and 35 should have

Stocks Under $5 Per Share

Great tools and consolidates most of the main info feeds in one place. Also medmen is my number one stock rn MMNFF. Has run from. 17 to last. Best Stocks Under $5 To Buy This Month · 1. Ambev S.A. (NYSE: ABEV): $ per Share · 2. Braemar Hotels & Resorts (NYSE: BHR): $ per Share · 3. Sachem Capital. Top Stocks Under $5 include Chesapeake Energy, Zynga, and Groupon, the online deal site made famous from socialization of coupons. #1 - GeoVax Labs. NASDAQ:GOVX. Stock Price: $ (+$). Market Cap: $ million. Stocks that trade for less than $5 are typically among the highest risk investments in the market. But there are a handful of hidden gems among the thousands of. Energy stocks under $5 is a list of energy companies trading on NASDAQ, AMEX and NYSE. The energy stocks are trading under $5 per share and sorted by the. A penny stock refers to a small company's stock that typically trades for less than $5 per share. Although some penny stocks trade on large exchanges such as. Oil and Gas Stocks Under $6. Here is a table of 59 oil and gas stocks that trade at less than six dollars per share. These stocks can be extremely volatile. Penny stocks are stocks that trade at a very low price, typically below $5 per share. They are often issued by small or newly established companies with low. Great tools and consolidates most of the main info feeds in one place. Also medmen is my number one stock rn MMNFF. Has run from. 17 to last. Best Stocks Under $5 To Buy This Month · 1. Ambev S.A. (NYSE: ABEV): $ per Share · 2. Braemar Hotels & Resorts (NYSE: BHR): $ per Share · 3. Sachem Capital. Top Stocks Under $5 include Chesapeake Energy, Zynga, and Groupon, the online deal site made famous from socialization of coupons. #1 - GeoVax Labs. NASDAQ:GOVX. Stock Price: $ (+$). Market Cap: $ million. Stocks that trade for less than $5 are typically among the highest risk investments in the market. But there are a handful of hidden gems among the thousands of. Energy stocks under $5 is a list of energy companies trading on NASDAQ, AMEX and NYSE. The energy stocks are trading under $5 per share and sorted by the. A penny stock refers to a small company's stock that typically trades for less than $5 per share. Although some penny stocks trade on large exchanges such as. Oil and Gas Stocks Under $6. Here is a table of 59 oil and gas stocks that trade at less than six dollars per share. These stocks can be extremely volatile. Penny stocks are stocks that trade at a very low price, typically below $5 per share. They are often issued by small or newly established companies with low.

How Much Money Do You Need to Invest in Penny Stocks? Since penny stocks are less than $5 per share, you don't need a ton of money to get started. I. How Much Money Do You Need to Invest in Penny Stocks? Since penny stocks are less than $5 per share, you don't need a ton of money to get started. I. Great tools and consolidates most of the main info feeds in one place. Also medmen is my number one stock rn MMNFF. Has run from. 17 to last. The stock market dynamics sparked Sristi's interest during her school days, which led her to become a financial journalist. Investing in undervalued stocks with. #7 - Unicycive Therapeutics. NASDAQ:UNCY. Stock Price: $ (-$). P/E Ratio: Penny stocks are typically issued by small companies and cost less than $5 per share. " Some penny stock investors may buy tens of thousands of shares for a. A penny stock refers to a small company's stock that typically trades for less than $5 per share. Although some penny stocks trade on large exchanges such as. Stocks Under $10 · Avalo Therapeutics Inc AVTX. Price: $ Daily change · Faraday Future Intelligent Electric Inc - Ordinary Shares - Class A FFIE. Price. Top Stocks Under $5 include Chesapeake Energy, Zynga, and Groupon, the online deal site made famous from socialization of coupons. Stocks under $5 per share are referred to as “penny stocks”. These stocks are considered to be high-risk, high-reward investments. Best stocks under $10 to buy · Tencent Music Entertainment Group (TME) · Clarivate PLC (CLVT) · iQIYI Inc. (IQ) · PagSeguro Digital Ltd. (PAGS) · Fisker Inc. (FSR). 9 Best Cheap Stocks to Buy Under $5 · Ambev SA (ticker: ABEV) · Sirius XM Holdings Inc. (SIRI) · Enel Chile SA (ENIC) · LG Display Co. Ltd. (LPL) · Latham Group Inc. Penny stocks are typically issued by small companies and cost less than $5 per share. " Some penny stock investors may buy tens of thousands of shares for a. The Best Stocks Under $1 at a Glance ; CVE: INX. $ $11,4m. 5, ; NASDAQ: SESN. $ $m. , And part of that is choosing whether to short stocks under $5 or above. So you borrow some of its shares from a brokerage firm and sell all of. Stocks that trade under $5 per share are considered cheap stocks. However, unlike stocks under $20 or stocks under $10, stocks under $5 are placed in a. (PERF): A Popular AI Penny Stock Under $5. Maham Fatima. Mon, Aug 26, 7 min read. In this article: PERF-WS. We recently compiled a list of the 7 Most. For example, investing $ into a company's stock that is trading for $ per share will get you shares. In this special presentation, we're looking. The company's products and services include loan services and investment services. STOCK MARKET OUTLOOK. As of March 31, , coupled with FINV's. If you're interested in exploring more stocks under $5 get an edge over other traders with Benzinga Pro while we're currently offering a day trial.

Top Five Life Insurance Company

:max_bytes(150000):strip_icc()/dotdash-INV-best-life-insurance-companies-48458581-f648a4009ae44c0097b2ae4f8bfd09db.jpg)

2, Ping An Ins (Group) Co of China Ltd. China ; 3, Berkshire Hathaway Inc. United States ; 4, China Life Insurance (Group) Company, China ; 5, AXA S.A., France. Of the 28 life insurance companies we evaluated, our analysis determined that the best life insurance company is Pacific Life. Of the 28 life insurance companies we evaluated, our analysis determined that the best life insurance company is Pacific Life. In , Aviva paid out % of their life insurance and critical illness claims. This puts them close to the top in terms of payout rate, giving you. © National Association of Insurance Commissioners. LIFE AND FRATERNAL INSURANCE INDUSTRY. TOP 25 GROUPS AND COMPANIES BY COUNTRYWIDE PREMIUM. States. After you have decided which kind of life insurance is best for you, compare similar policies from different companies to find which one is likely to give you. © National Association of Insurance Commissioners. LIFE AND FRATERNAL INSURANCE INDUSTRY. TOP 25 GROUPS AND COMPANIES BY COUNTRYWIDE PREMIUM. States. five-star rating from NerdWallet, and have been named one of the best life insurance 9 CNBC, Here are the 6 best life insurance companies of , Top 10 Writers Of Property/Casualty Insurance By Direct Premiums Written, ; 4, Allstate Corp. 50,, ; 5, Liberty Mutual, 44,, ; 6, Travelers. 2, Ping An Ins (Group) Co of China Ltd. China ; 3, Berkshire Hathaway Inc. United States ; 4, China Life Insurance (Group) Company, China ; 5, AXA S.A., France. Of the 28 life insurance companies we evaluated, our analysis determined that the best life insurance company is Pacific Life. Of the 28 life insurance companies we evaluated, our analysis determined that the best life insurance company is Pacific Life. In , Aviva paid out % of their life insurance and critical illness claims. This puts them close to the top in terms of payout rate, giving you. © National Association of Insurance Commissioners. LIFE AND FRATERNAL INSURANCE INDUSTRY. TOP 25 GROUPS AND COMPANIES BY COUNTRYWIDE PREMIUM. States. After you have decided which kind of life insurance is best for you, compare similar policies from different companies to find which one is likely to give you. © National Association of Insurance Commissioners. LIFE AND FRATERNAL INSURANCE INDUSTRY. TOP 25 GROUPS AND COMPANIES BY COUNTRYWIDE PREMIUM. States. five-star rating from NerdWallet, and have been named one of the best life insurance 9 CNBC, Here are the 6 best life insurance companies of , Top 10 Writers Of Property/Casualty Insurance By Direct Premiums Written, ; 4, Allstate Corp. 50,, ; 5, Liberty Mutual, 44,, ; 6, Travelers.

What Are The Top 10 Life Insurance Companies In India ? · Aditya Birla Sun Life Insurance · Bajaj Allianz Life Insurance Company · Canara HSBC OBC Life. Five independent agencies—AM Best, Fitch, Kroll Bond Rating Agency (KBRA), Moody's and Standard & Poor's—rate the financial strength of insurance companies. List of life insurance companies ; 1, New York Life Group, % ; 2, Northwestern Mutual Group, % ; 3, Metropolitan Group, % ; 4, Prudential of America. MetLife (Metropolitan Life Insurance Company) · Prudential Financial · TIAA-CREF (Teachers Insurance and Annuity Association – College Retirement Equities Fund). MassMutual: Best overall · Guardian: Best for applicants with a history of HIV · Northwestern Mutual: Best for consumer experience · New York Life: Best for high. Best companies' hands down are going to be National Life group, Aig, Foresters and Protective. Without knowing a little bit about your background and health. Program Also Achieves Highest National Marks! July 25, · NEWS RELEASE: Five Insights to Help Ohioans Navigate Medicare Smoothly. Five trending. five-star rating from NerdWallet, and have been named one of the best life insurance 9 CNBC, Here are the 6 best life insurance companies of , Guardian and MassMutual top our list of the best term life insurance companies in Read more · 3 Best No. Primerica's life insurance companies offer affordable term life insurance protection ranging from a year level premium policy all the way up to a year. Best companies' hands down are going to be National Life group, Aig, Foresters and Protective. Without knowing a little bit about your background and health. Once you have an insurance agent or company who you feel confident doing business with: insurance for the period of your greatest need for life insurance to. Over the last five years mutual insurers were approximately. points higher than stock insurers. A mutual insurance company is an insurance company that. Those enviable statistics belong to our parent company, Allianz SE. Founded in in Germany, today Allianz SE is among the world's top five largest insurers. Through Progressive Life Insurance Company, coverage options range from $50, to $1 million. Keep in mind that permanent life policies generally cost more. Five independent agencies—AM Best, Fitch, Kroll Bond Rating Agency (KBRA), Moody's and Standard & Poor's—rate the financial strength of insurance companies. The Cincinnati Insurance Companies strive to be Everything Insurance Should Be® by offering insurance solutions for businesses and individuals through local. Nationwide and MassMutual are in a tie for No. 3 with Lincoln Financial Group rounding out our top five. Similar to whole life, universal life insurance. Once you have an insurance agent or company who you feel confident doing business with: insurance for the period of your greatest need for life insurance to. You can buy life insurance from an insurance company, agent, or broker. Most companies will reinstate a policy within a five-year period. To.

How Can I Remove Derogatory Marks From My Credit Report

Of course! You can write a letter to Experian, Transunion, and Equifax and explain why they are incorrect, and the credit bureaus will look into. A simple step-by-step guide to remove all derogatory items on your credit reports, even if they do belong to you! First step is to contact each of the 3 credit reporting agencies (TransUnion, Equifax, Experian) and request your free annual credit report. You. The credit bureau must remove accurate, negative information from your report only if it is over 7 years old. Bankruptcy information can be reported for How to Fix Derogatory Marks · Review Your Credit Report · Dispute Inaccuracies · Negotiate Pay-for-Delete · Settle or Pay · Seek Professional Assistance · Case. If you have the money to pay off derogatory credit, negotiate a “pay for delete” with the collection agency. Have a credit repair service dispute derogatory. How to get derogatory marks removed from your credit report · Contact the credit bureaus to alert them of the error. · Provide a written explanation of why you. You may want to enclose a copy of your credit report with the items in question circled. Send your letter by certified mail with “return receipt requested,” so. So, if the Date of First Delinquency is January , the tradeline will be removed in Making a payment or settling a charged-off account. Of course! You can write a letter to Experian, Transunion, and Equifax and explain why they are incorrect, and the credit bureaus will look into. A simple step-by-step guide to remove all derogatory items on your credit reports, even if they do belong to you! First step is to contact each of the 3 credit reporting agencies (TransUnion, Equifax, Experian) and request your free annual credit report. You. The credit bureau must remove accurate, negative information from your report only if it is over 7 years old. Bankruptcy information can be reported for How to Fix Derogatory Marks · Review Your Credit Report · Dispute Inaccuracies · Negotiate Pay-for-Delete · Settle or Pay · Seek Professional Assistance · Case. If you have the money to pay off derogatory credit, negotiate a “pay for delete” with the collection agency. Have a credit repair service dispute derogatory. How to get derogatory marks removed from your credit report · Contact the credit bureaus to alert them of the error. · Provide a written explanation of why you. You may want to enclose a copy of your credit report with the items in question circled. Send your letter by certified mail with “return receipt requested,” so. So, if the Date of First Delinquency is January , the tradeline will be removed in Making a payment or settling a charged-off account.

You may be able to ask the collection agency, the original creditor or both to request the credit bureaus delete the delinquency from your credit reports as a. Whether your attempts to use pay for delete are successful can depend on whether you're dealing with the original creditor or a debt collection agency. "As to. If you have reviewed your credit report and believe it contains errors, you have the right to dispute inaccuracies with the credit reporting agencies. One option you could pursue is a “pay-for-delete.” This is when you negotiate with your creditor to have negative information removed from your credit reports. How to remove derogatory marks from your credit report · Submit your dispute to the credit bureau · Dispute the remark with your credit card issuer · Write a. Find all the things you want to dispute at each individual credit reporting agency's report. Then write a simple and straight forward letter. If you see information on your credit reports you believe is incomplete or inaccurate, a good first step is to contact the lender or creditor directly. If you have historically had good behavior and are experiencing financial difficulties, try calling your lender to negotiate a hardship plan. You may also. Whether your attempts to use pay for delete are successful can depend on whether you're dealing with the original creditor or a debt collection agency. "As to. This is when the creditor puts in writing that they're going to remove the derogatory mark from your credit report, which will likely boost your credit. To. Transunion · Ask the credit bureau to remove or correct the inaccurate or incomplete information. · Include: your complete name and address; each mistake that you. You can usually remove dings to your credit report by disputing the matter with the credit reporting agency in writing. The creditor will have a. If any derogatory mark on your credit report is erroneous, you have the right to dispute it and have it removed from your credit report. However, if they are. You can negotiate with debt collection agencies to remove negative information from your credit report. If you send a goodwill letter requesting that a creditor remove a derogatory mark on your credit report, the worst thing they can do is say no. Though it's. You may be able to remove the charge-off by disputing it or negotiating a settlement with your creditor or a debt collector. Your credit score can also steadily. To get an incorrect late payment removed from your credit report, you need to file a dispute with the credit bureau that issued the report containing the error. You may want to enclose a copy of your credit report with the items in question circled. Send your letter by certified mail with “return receipt requested,” so. Learn more about how to dispute a credit report. You can file a dispute if you believe your TransUnion credit report contains inaccurate information. If you have a derogatory mark on your credit report, you can take proactive steps to remove it. For ones due to errors, dispute it with the credit bureau in.

Fixed Income Style Box

Fixed income funds help you generate income with the exception of the Thrivent Money Market Fund which focuses on maintaining principal. For domestic fixed-income categories, wherever reference has been made to “Map B” for the style box field and if the style box information is missing, the. Fixed-Income Style Box. Listed for both domestic and international fixed-income funds, with the exception of convertible bond funds. The model for the fixed income style box is based on the two pillars of fixed-income style boxes appear. Portfolio. Turnover. Portfolio turnover is a. Just as there is a Mutual Fund Style Box to categorize stock funds, Morningstar has created a Fixed-Income Style Box. The Fixed-Income Style Box classifies. The style box allows investors to quickly gauge the risk exposure of their bond fund. The horizontal axis of the fixed-income style box displays a fund's. The style box categorizes funds based on market capitalization (large-cap, midcap, small-cap) and investment style (value, blend, growth). Investors and. The fixed income style box demonstrates the two most important and distinguishing characteristics of fixed income funds: credit quality and interest rate. Learn more about the Morningstar Style Box, which reveals a fund's investment strategy, and can be used for both equity funds and fixed-income funds. Fixed income funds help you generate income with the exception of the Thrivent Money Market Fund which focuses on maintaining principal. For domestic fixed-income categories, wherever reference has been made to “Map B” for the style box field and if the style box information is missing, the. Fixed-Income Style Box. Listed for both domestic and international fixed-income funds, with the exception of convertible bond funds. The model for the fixed income style box is based on the two pillars of fixed-income style boxes appear. Portfolio. Turnover. Portfolio turnover is a. Just as there is a Mutual Fund Style Box to categorize stock funds, Morningstar has created a Fixed-Income Style Box. The Fixed-Income Style Box classifies. The style box allows investors to quickly gauge the risk exposure of their bond fund. The horizontal axis of the fixed-income style box displays a fund's. The style box categorizes funds based on market capitalization (large-cap, midcap, small-cap) and investment style (value, blend, growth). Investors and. The fixed income style box demonstrates the two most important and distinguishing characteristics of fixed income funds: credit quality and interest rate. Learn more about the Morningstar Style Box, which reveals a fund's investment strategy, and can be used for both equity funds and fixed-income funds.

Morningstar Fixed Income Style Box · Seek income and total return, consistent with preservation of capital · Have a medium to long-term investment time horizon. We list Average Effective Maturity for. Taxable Fixed-Income and Hybrid funds and Average Nominal Maturity for Municipal Bond Funds. Equity Style. Box. The. , Morningstar Style BoxTM 06/30/24 More Information Morningstar Equity Style Box. Morningstar Fixed Income Style Box. Top Sectors 07/31/24 06/ Fixed Income Style Box. (as of 7/31/) Overview chart. Placement within the Morningstar Fixed-Income Style Box™ is based on two variables: the vertical. The Fixed Income Style Box provides a visual representation detailing a fund's credit quality and its sensitivity to interest rate fluctuations. Equity style boxes (stock funds) and fixed income style boxes (bond funds) represent two-dimensional (horizontal and vertical axis) views of risk versus return. income and capital appreciation by investing primarily in Investment Grade fixed income securities. Morningstar Style Box®. Fixed Income Style. Asset. Fixed Income. Category, Taxable. Objective, Current Income The initial and deferred sales fees do not apply to fee-based accounts. Fixed Income Style Box. The model for the fixed income style box is based on the two pillars of For hybrid funds, both equity and fixed-income style boxes appear. Use the Morningstar Style Box.” Statistics Price/Earnings Ratio: The price to Morningstar Fixed-Income Style Box. Low. Medium. High. Limited. Moderate. Vanguard uses a 9-box grid called a style box to illustrate how our bond fund holdings are distributed by credit quality and average maturity. The Fixed income Style box is a two-dimensional grid that plots bond funds based on two key dimensions: credit quality and duration. credit quality refers to. descriptions to better understand the “investment style” of stocks and mutual funds. Morningstar Equity Style Box. Morningstar Fixed-Income Style Box. Value. style characteristics (value, core, and growth). The Fixed-Income Style box shows how bond holdings are classified in terms of their credit quality (high. Morningstar splits fixed-income funds into three groups of interest rate sensitivity (high, medium, and low) and three credit-quality groups (high, medium, and. Fixed-Income Style The Morningstar Style Box is a nine-square grid that provides a graphical representation of the "investment style" of mutual funds as of. The model for the fixed-income style box is based on the two pillars of fixed-income performance: interest-rate sensitivity and credit quality. The three. Source: Morningstar®. The style box reveals a fund's investment style. The vertical axis shows the market capitalization of the stocks owned and the horizontal. The mutual fund industry has long relied on Morningstar's nine equity and nine fixed income style boxes to define investment factors.1 Equity style boxes define. Fixed-Income Market Pulse. A summary of fixed-income markets performance Style Box · Trade My Account · Advisor Center. Access exclusive advisor-only.

Best Way To Refinance House

Ideally, this new loan comes with better terms than your old one. This depends on a number of factors, including current mortgage rates, how much equity you. Ask for Referral. The best way to find the right bank for an investment property refinance is to ask around. People are often happy to share their experiences. Refinancing is just like financing in the first place. You are trying to get a new mortgage on your property for one reason or the other. In the. You can refinance through your existing lender or a new lender. What's most important is that the lender you choose is trustworthy and offers competitive rates. Consider refinancing if: interest rates have fallen, your home is worth more, a. 3. A Different Type of Mortgage Works Better. The two most common. Bank of America is the best bank for mortgage refinances in many situations as you can apply online or at one of its many branch locations nationwide. This. There are many different refinancing options for homeowners to choose from. Learn more about some of the most popular types of refinances and how they work. What's your reason for mortgage refinancing? Maybe you want to lower your monthly payment, change the loan term, get a lower interest rate, or tap into your. Local credit union is your best bet. It also depends on how much the value of your home is compared to how much you owe. That will determine the. Ideally, this new loan comes with better terms than your old one. This depends on a number of factors, including current mortgage rates, how much equity you. Ask for Referral. The best way to find the right bank for an investment property refinance is to ask around. People are often happy to share their experiences. Refinancing is just like financing in the first place. You are trying to get a new mortgage on your property for one reason or the other. In the. You can refinance through your existing lender or a new lender. What's most important is that the lender you choose is trustworthy and offers competitive rates. Consider refinancing if: interest rates have fallen, your home is worth more, a. 3. A Different Type of Mortgage Works Better. The two most common. Bank of America is the best bank for mortgage refinances in many situations as you can apply online or at one of its many branch locations nationwide. This. There are many different refinancing options for homeowners to choose from. Learn more about some of the most popular types of refinances and how they work. What's your reason for mortgage refinancing? Maybe you want to lower your monthly payment, change the loan term, get a lower interest rate, or tap into your. Local credit union is your best bet. It also depends on how much the value of your home is compared to how much you owe. That will determine the.

Subtract your mortgage balance from your home's current value. Refinancing lets you borrow up to 80% of that value minus how much you still owe on your property. Discuss your project with your mortgage advisor. Explain your needs and show them your documents. You can review products and interest rates together to find. Home loan refinancing is generally a good idea if you can get a lower interest rate. Homeowners who need some extra cash for home renovations or to pay-off debt. You must pay off your current mortgage and replace it with a new mortgage that has better rates or terms in order to refinance your home with a Conventional. It can be a good idea to refinance your mortgage when it lowers your interest rate and monthly payment by enough to improve your monthly budget. Also. They're great ways to pay for things like home improvements, tuition, big events and more. Home equity loan. Better if you have a one-time expense. Most experts recommend refinancing a mortgage if you can lower your current interest rate by at least to 1 percent. Also, it's a good idea not to plan to. Much like your original mortgage, the refinancing process involves a thorough review of your current financial status. Lenders reassess your credit score, home. Historically, many mortgage experts have said that a good time to refinance is when market rates dip 1% below the interest rate you currently pay. Of course, if. Depending on the terms of your current loan and how long you plan to stay in your home, refinancing could be the best option for you. Whether you have an. Refinancing lets you switch between an adjustable-rate mortgage and a fixed-rate mortgage to better suit your financial needs. To lower your monthly payment. Best refinance lender overall: Guaranteed Rate · Best online mortgage refinance experience from a traditional bank: Chase · Best for online refinance rate. Best Mortgage Refinance Lenders of September · Best Mortgage Lenders for Refinancing · New American Funding · Rocket Mortgage · AmeriSave · Farmers Bank of. To start or fund a business: A cash-out refinance can be a good way to get money to start or fund a business. The interest rate on a mortgage is usually. How to Refinance Your Home Mortgage Loan If you have been asking yourself “How do I refinance my home?”, the process is easier than you think. Your first step. Contact your mortgage lender for more information on the best refinance options for your specific needs. You can choose the lender you already worked with for. A better way to refinance your first mortgage. · Apply Online in Just Minutes · $0 Costs at Closing · Help on Hand 7 Days a Week. In this way, refinancing your mortgage may help you save money by adjusting the interest rates or monthly loan payments attached to your current loan. However. How do I qualify for mortgage refinancing? · Credit Score: Lenders want to make sure the borrower is in good standing (financially) before offering them a new. Closing on your mortgage refinance usually takes place in the presence of a public notary, and if you have a co-applicant, then they will also need to be.

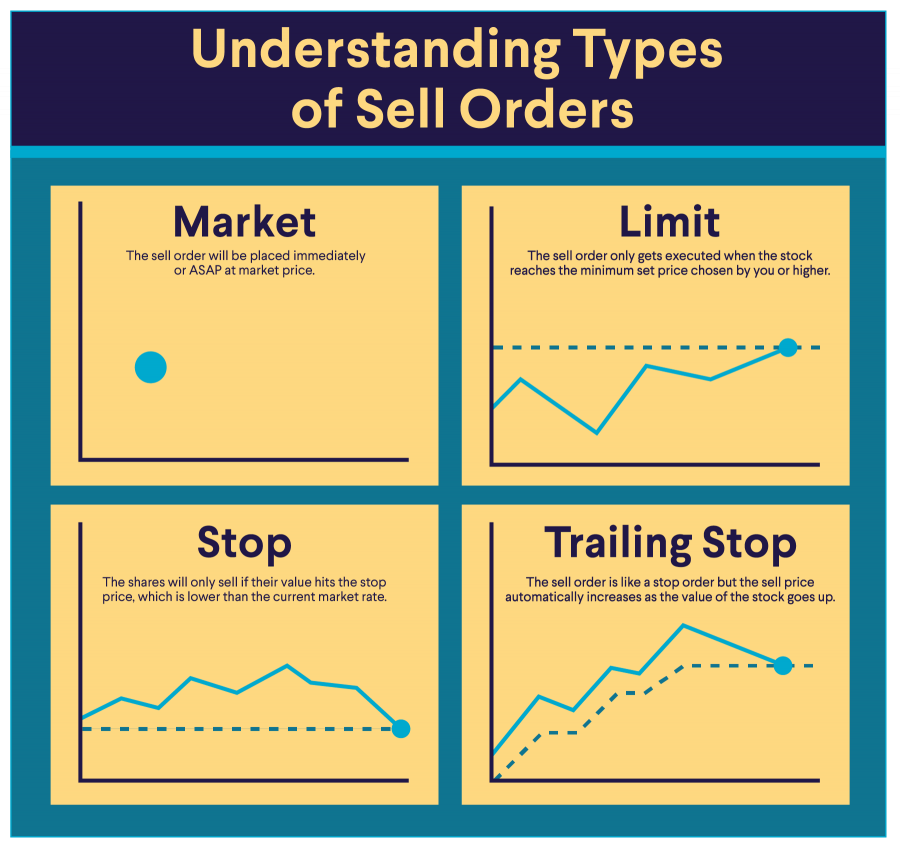

When Can You Sell Stocks

The idea is that you never know when a stock might rise or fall, but by buying the same stock regularly, you're more likely to get it for a good price and less. You can analyze corporate profits, valuations, the economic outlook and what's happening with interest rates to inform your portfolio decisions, for example. Regardless of whether an investment has lost or gained value, you should never keep it if it no longer fits your strategy. That said, it can be hard to let go. Through your brokerage. Selling your stocks directly through your brokerage is probably your safest bet to dump shares the quickest. Whether you use a. As long as the stock keeps trending up, we're happy to hang on. If the stock pulls back 25% from its closing high, we sell. No questions asked. The wash sale rule states that if you buy or acquire a substantially identical stock within 30 days before or after you sold the declining stock at a loss, you. When you sell stocks, you could face tax consequences. These tips may help you limit what you owe and reduce capital gains taxes on stocks. When the price of a stock increases enough to recoup any trading fees, you can sell your shares at a profit. These profits are known as capital gains. In. 1. You Made a Bad Investment · 2. The Stock Has Reached Your Target Price · 3. The Stock's Valuation is High · 4. Selling for the Opportunity Cost · 5. You Need the. The idea is that you never know when a stock might rise or fall, but by buying the same stock regularly, you're more likely to get it for a good price and less. You can analyze corporate profits, valuations, the economic outlook and what's happening with interest rates to inform your portfolio decisions, for example. Regardless of whether an investment has lost or gained value, you should never keep it if it no longer fits your strategy. That said, it can be hard to let go. Through your brokerage. Selling your stocks directly through your brokerage is probably your safest bet to dump shares the quickest. Whether you use a. As long as the stock keeps trending up, we're happy to hang on. If the stock pulls back 25% from its closing high, we sell. No questions asked. The wash sale rule states that if you buy or acquire a substantially identical stock within 30 days before or after you sold the declining stock at a loss, you. When you sell stocks, you could face tax consequences. These tips may help you limit what you owe and reduce capital gains taxes on stocks. When the price of a stock increases enough to recoup any trading fees, you can sell your shares at a profit. These profits are known as capital gains. In. 1. You Made a Bad Investment · 2. The Stock Has Reached Your Target Price · 3. The Stock's Valuation is High · 4. Selling for the Opportunity Cost · 5. You Need the.

The best day of the month to sell stock would probably be one of the days leading to the last trading day of the month. The week leading up to the end of the. To grow your portfolio substantially, take most gains in the 20%% range. Though contrary to human nature, the best way to sell a stock is while it's on the. Traders know the price-moving news is old by the time the market opens. So they can buy and sell during these first few minutes and hours with the full. You never know what news might hit after the close, and there's always the potential for the stock to gap lower the next trading day. On the other hand, end of. Online Brokerage Accounts There are numerous online brokerage accounts and digital apps where investors can buy and sell stocks to build a portfolio. Online. Retail investors can buy and sell stock on the same day—as long as they don't break FINRA's PDT rule, adopted to discourage excessive trading. It is always possible to sell a stock for profit purposes, as the Income Tax Department has you paying taxes on the profit you make. This is, as mentioned. To grow your portfolio substantially, take most gains in the 20%% range. Though contrary to human nature, the best way to sell a stock is while it's on the. Yes, traders can trade stocks over the weekend. While most stock exchanges operate on a 9am-5pm and five days a week format, trading on weekends is made. If you would like to sell stock using Cash App Investing: Tap the Money tab on your Cash App home screen; Tap on the Stocks Tile; Scroll down to Stocks. So, while you can sell the shares any time after you bought them, you need to keep these points in mind. Let us take the first example again. Usually this takes two to three days. Be aware that withdrawing this money completely, say to your bank account, can take another few days. . . Freetrade is. How to buy stocks. You can buy or sell stocks by opening a brokerage account through a financial services firm. Your financial advisor can help you get started. Many investors will immediately sell a stock after it decides to cut its dividend, but we do our best to get out before the reduction is made. We gauge the risk. When selling securities, you should be able to identify the specific shares you are selling. If you can identify which shares of stock you sold, your basis. In the best case, of course, you might want to sell a stock once you've met your goals. Perhaps the price is right, or you're ready to retire, or you've crossed. Go to the stock's detail page. · Select Trade → Sell · By default, you're asked to enter the amount you would like to sell in dollars. · Review your order and. Here we show you some of the more common selections. Select a Price Type: Market: Choose this type to buy or sell a security such as a stock that will be. Usually this takes two to three days. Be aware that withdrawing this money completely, say to your bank account, can take another few days. . . Freetrade is. No, shareholders with significant amounts of shares and insider knowledge are not allowed to sell any amount of shares at any time. Also.

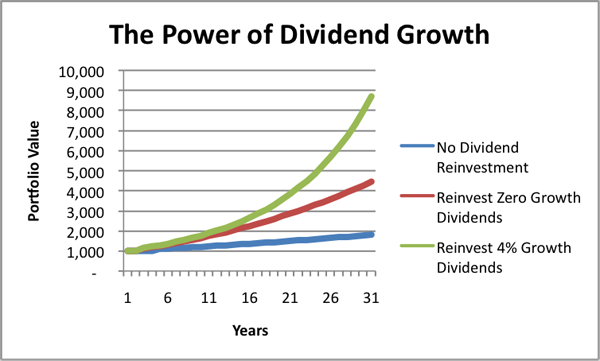

How Does Dividend Reinvestment Work

How do DRIPs work? DRIPs work by reinvesting a set amount of earned dividends on the date they are usually paid out. “You purchase additional fractional. Since the purchases within DRIPs are done automatically, the price paid for the shares through the dividend reinvestment is determined by an average cost of the. The Dividend Reinvestment Plan (DRIP) allows you to automatically reinvest the cash dividendsLegal Disclaimer footnote 1 you earn from your equity investments. How dividend reinvestment plans work Usually, dividends are paid by check or electronic deposit, which are sent automatically to investors, either quarterly. With dividend reinvestment, you are buying more shares with the dividend that you're paid, rather than pocketing the cash. Reinvesting can help you build wealth. To use the dividend reinvestment service, log in to your account and from the 'My account' menu, choose 'Dividend reinvestment'. You'll be able to choose. When reinvesting dividends for other eligible securities, Vanguard Brokerage Services combines the cash distributions from the accounts of all clients who have. A DRP is a plan offered by a company or ETF manager that allows you to automatically reinvest your cash dividends/distributions in additional shares of the. A dividend reinvestment plan (DRIP or DRP) is a plan offered by a company to shareholders that it allows them to automatically reinvest their cash dividends in. How do DRIPs work? DRIPs work by reinvesting a set amount of earned dividends on the date they are usually paid out. “You purchase additional fractional. Since the purchases within DRIPs are done automatically, the price paid for the shares through the dividend reinvestment is determined by an average cost of the. The Dividend Reinvestment Plan (DRIP) allows you to automatically reinvest the cash dividendsLegal Disclaimer footnote 1 you earn from your equity investments. How dividend reinvestment plans work Usually, dividends are paid by check or electronic deposit, which are sent automatically to investors, either quarterly. With dividend reinvestment, you are buying more shares with the dividend that you're paid, rather than pocketing the cash. Reinvesting can help you build wealth. To use the dividend reinvestment service, log in to your account and from the 'My account' menu, choose 'Dividend reinvestment'. You'll be able to choose. When reinvesting dividends for other eligible securities, Vanguard Brokerage Services combines the cash distributions from the accounts of all clients who have. A DRP is a plan offered by a company or ETF manager that allows you to automatically reinvest your cash dividends/distributions in additional shares of the. A dividend reinvestment plan (DRIP or DRP) is a plan offered by a company to shareholders that it allows them to automatically reinvest their cash dividends in.

How do I withdraw some or all of my common shares from the plan? You may We are grateful to have the opportunity to work in this territory. We. Advantages of the Plan · Convenience of having cash dividends automatically reinvested into common shares instead of receiving cash payments · Ability to purchase. Dividend reinvestment plans work by using the cash dividend from the investment portfolio to buy more of the underlying investment. Stage 1: For instance, let. Key Takeaways · A dividend reinvestment plan, or DRIP, automatically uses the proceeds generated from dividend stocks to purchase more shares of the company. Use the Dividend Reinvestment Program (DRIP) to reinvest dividend payouts to buy additional shares without paying a commission. You can automatically reinvest cash dividend payments back into the underlying stock or ETF with dividend reinvestment (DRIP). Dividend reinvestment is a popular way to increase your holdings in a company without having to invest additional funds. It is a process where the dividends. When you enroll in a DRIP, your dividends are automatically reinvested back into more shares of the stock. · The true beauty of DRIPs lies within the compounding. How does a dividend reinvestment plan work? When an investor owns dividend paying stocks, cash dividends are typically paid in the form of a check or direct. A dividend reinvestment plan is a variant of mutual funds wherein the dividend declared by the mutual fund is reinvested in the mutual fund. Instead of receiving dividend payments via cheque or into a bank account, Computershare's DRIP enables the shareholder to buy additional shares with dividend. Changing reinvestment options does not impact special or optional dividends. Instructions: • Please print and complete the form. • Send the completed form. A dividend reinvestment program or dividend reinvestment plan (DRIP) is an equity investment option offered directly from the underlying company. With a dividend reinvestment plan (or DRIP), the dividends you are paid from a company are reinvested to purchase more shares, allowing you to grow your. Reinvested dividends, however, purchase additional shares, leveraging the power of compounding. While cash dividends offer liquidity, reinvested dividends. Reinvested dividends, however, purchase additional shares, leveraging the power of compounding. While cash dividends offer liquidity, reinvested dividends. DRIPs are dividend reinvestment plans that allow investors to receive additional shares in the place of cash dividends. To enroll in DRIP, you need to call your. A dividend reinvestment plan is a type of investment account that allows investors to reinvest or "roll over" their dividends to buy more shares of the company. One way to reinvest dividends is by receiving the dividend payments as cash in a brokerage account and then using that cash to buy more shares of the same. Dividends will then be reinvested during market hours ( AM to 4 PM ET) on the trading day after the dividend pay date. Because it typically takes some time.

How To Get Rid Of My Car Payment

Keep Paying Off Your Car's Loan · Pay Extra On Your Loan Payment Per Month · Consider Refinancing · Sell the Car to a Private Party · Take Out a Loan. Some car dealers advertise that, when you trade in your car to buy another one, they'll pay off the balance of your loan. No matter how much you owe. If you want to be rid of it quickly and easily, find your local Carmax or Echo Park dealership, and they'll make you an offer. Can I get approved for an auto loan before I pick out my car? Yes. Your You have multiple auto loan payment options: Pay using Bill Pay: If you're. The very first thing you need to do is find out the accurate amount you still owe on your car. The easiest way to do this is to call your lender and have them. Once you've paid off your car loan and no longer have a monthly car payment, chances are that you'll have some extra money in your budget. It's always a wise. The fastest way to pay off a car loan is to simply pay cash for the remaining balance, but make sure to get a pay-off quote before sending in that payment. The very first thing you need to do is find out the accurate amount you still owe on your car. The easiest way to do this is to call your lender and have them. The best time to get a lower car payment is before you finance your purchase of a new car. That's when you can shop around for low interest rates and longer. Keep Paying Off Your Car's Loan · Pay Extra On Your Loan Payment Per Month · Consider Refinancing · Sell the Car to a Private Party · Take Out a Loan. Some car dealers advertise that, when you trade in your car to buy another one, they'll pay off the balance of your loan. No matter how much you owe. If you want to be rid of it quickly and easily, find your local Carmax or Echo Park dealership, and they'll make you an offer. Can I get approved for an auto loan before I pick out my car? Yes. Your You have multiple auto loan payment options: Pay using Bill Pay: If you're. The very first thing you need to do is find out the accurate amount you still owe on your car. The easiest way to do this is to call your lender and have them. Once you've paid off your car loan and no longer have a monthly car payment, chances are that you'll have some extra money in your budget. It's always a wise. The fastest way to pay off a car loan is to simply pay cash for the remaining balance, but make sure to get a pay-off quote before sending in that payment. The very first thing you need to do is find out the accurate amount you still owe on your car. The easiest way to do this is to call your lender and have them. The best time to get a lower car payment is before you finance your purchase of a new car. That's when you can shop around for low interest rates and longer.

If you have the financial means, you can pay the difference between the car's value and the loan balance out of pocket. This will allow you to clear the. You may even be able to offset any negative equity you have in your loan if you set the price high enough. If this option sounds right for you, make sure to let. In Chapter 13, your car loan will become part of your bankruptcy plan which will be paid by your trustee. Your car payment could remain the same, but you can. If you can hold off on buying a new vehicle, you can reduce your negative equity by making extra payments on the car loan. Delaying a trade-in is often the best. If you want to be rid of your vehicle but will need a new vehicle to replace it within quick succession, it is more advisable to continue making your payments. If you take on a loan that has a longer repayment term, it might have a lower interest rate but you could end up paying more in total interest than you would. What steps should I take before paying off my loan? Allowing the lender to repossess the vehicle is the final option for escaping a bad auto loan. You may voluntarily return the vehicle and request that the. 1. Make a lump-sum payment. If you have the money and want to get out of the loan as soon as possible, paying off your vehicle loan in one lump sum is probably. If you want to be rid of your vehicle but will need a new vehicle to replace it within quick succession, it is more advisable to continue making your payments. If you have the financial means, you can pay the difference between the car's value and the loan balance out of pocket. This will allow you to clear the. Reduce Your Term Length · Try Out A New Budget · Look For A Side Gig · Make Extra Payments · Refinance. Allowing the lender to repossess the vehicle is the final option for escaping a bad auto loan. You may voluntarily return the vehicle and request that the. Your lender doesn't want you to default on your auto loan. In many cases, they may work with you to come up with a temporary solution to make your loan. Going above and beyond on your monthly auto loan payment is a smart way to upgrade your next driving experience. You'll have the option to put those saved. The very first thing you need to do is find out the accurate amount you still owe on your car. The easiest way to do this is to call your lender and have them. If you still want to surrender the car, you can try to work something out with the creditor, like negotiating a reduction or waiver of the loan balance as a. If your car's equity is worth $10, or less, you'll keep the car in Chapter 7, and your Chapter 13 payment won't be affected—you won't have to pay to keep. A long-term solution for securing a lower car payment is to improve your credit score. Keeping your credit score up typically increases your chances of getting. 1. Make a lump-sum payment. If you have the money and want to get out of the loan as soon as possible, paying off your vehicle loan in one lump sum is probably.